The news that the United States has halted the production of circulating dollar coins is already fish and chips paper. The treasury's problem now is to get rid of the 1.4 billion dollar coins that are on hand. One way the treasury gets rid of the coins is through the circulating dollar direct shop program of the US mint. The mint, however, has altered the program for the worse (from a consumer standpoint). For every box of dollar coins ordered, there is a new $12.50 "order fulfillment charge." Credit card payments are no longer accepted. Instead, payment must be by wire transfer, check, or money order.

If the public didn't want the coins before, now they really won't want them. It took the treasury over 75 years to get rid of all the unwanted morgan dollars . I wish the mint luck in getting rid of the presidential dollars. They will need it.

The Dollar Coin is Dead

It's over. The United States has pulled the plug on the much ballyhooed dollar coin . The announcement was made by vice president Joe Biden. The obvious problem was that they were unpopular. The treasury is currently sitting on 1.4 billion dollar coins that they cannot get rid of. Making more dollar coins would be silly. And so, it's back to the paper dollar for us.

I'm sure I sound like a broken record, but we've heard this song and dance before. It seems like only yesterday we buried the Susan B Anthony dollar , which replaced the equally unpopular Eisenhower dollar . The government policy had been similar to the policy of the late 1800's when millions of Morgan dollars were minted with no apparent purpose.

Collectors of presidential dollars need not fret. The mint will still be making enough of them to satisfy their needs.

For more information about the presidential dollar or my cynical history of the US dollar, please go to my presidential dollar page .

I'm sure I sound like a broken record, but we've heard this song and dance before. It seems like only yesterday we buried the Susan B Anthony dollar , which replaced the equally unpopular Eisenhower dollar . The government policy had been similar to the policy of the late 1800's when millions of Morgan dollars were minted with no apparent purpose.

Collectors of presidential dollars need not fret. The mint will still be making enough of them to satisfy their needs.

For more information about the presidential dollar or my cynical history of the US dollar, please go to my presidential dollar page .

Plastic Money? Good for Canada. Would it be good for the US?

The Canadian Government has just announced that it will be using plastic currency to replace their paper currency. The one hundred dollar bill is being introduced now, with the lower denominations following.

In the US, we have paper dollars, which wear out quickly. This has led to the debate about replacing the paper dollar with presidential dollar coins. Dollar coins have always been unpopular in the US. We prefer something to fold and keep in a wallet. Plastic currency could be a solution to this problem.

In the US, we have paper dollars, which wear out quickly. This has led to the debate about replacing the paper dollar with presidential dollar coins. Dollar coins have always been unpopular in the US. We prefer something to fold and keep in a wallet. Plastic currency could be a solution to this problem.

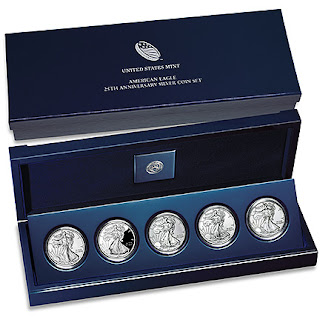

American Eagle 25th Anniversary set: A slick marketing ploy

Before I begin, let's get our pencils out and mark our calendars for October 27 at noon when the American Eagle 25th Anniversary silver set will be put on sale. The price has not yet been determined and the limit is currently five sets per household.

The set has two desirable pieces that our not available elsewhere: A 2011 S mint uncirculated dollar and a 2011 P mint reverse proof coin. In order to acquire these coins, we must purchase them in a set with three other coins (the W mint uncirculated, the W mint proof, and the generic mintmarkless uncirculated).

Veteran coin buyers are familiar with this marketing ploy by the mint. To acquire the 1998S matte Kennedy half, we had to put up with the Robert F Kennedy dollar. The 1997P matte Jefferson nickel was only available as part of the Botanical Garden Set.

The set has two desirable pieces that our not available elsewhere: A 2011 S mint uncirculated dollar and a 2011 P mint reverse proof coin. In order to acquire these coins, we must purchase them in a set with three other coins (the W mint uncirculated, the W mint proof, and the generic mintmarkless uncirculated).

Veteran coin buyers are familiar with this marketing ploy by the mint. To acquire the 1998S matte Kennedy half, we had to put up with the Robert F Kennedy dollar. The 1997P matte Jefferson nickel was only available as part of the Botanical Garden Set.

Should the Government Force the Dollar Coin Upon us?

David Schweikert of Arizona has introduced a bill in the House of Representatives has introduced the Currency Optimization, Innovation and National Savings Act (known as the COINS Act). The bill calls for the elimination of the paper dollar, to be completely replaced by the dollar coin. The author touts the tremendous national savings of 6 billion dollars over the next 30 years.

To put this into perspective, this comes out to about 200 million dollars per year. (Of course multiplying by thirty will make the number sound larger). Since the US has a population of about 300 million, this means that each citizen would save about 67 cents per year by switching away from the paper dollar.

Rather than asking citizens if we should save 6 billion dollars, we should be asking if citizens would be willing to give up the paper dollar in exchange for 67 cents. My guess is that many will be willing to pay the 67 cents for what they see as a convenience. After all, some banks now want to charge $60 per year for an ATM card.

I, of course, am a coin man. I pay for virtually everything in coins (much to the dismay of those waiting behind me in the checkout line). The question is whether the government should force all Americans to be more like me. What are your thoughts?

To put this into perspective, this comes out to about 200 million dollars per year. (Of course multiplying by thirty will make the number sound larger). Since the US has a population of about 300 million, this means that each citizen would save about 67 cents per year by switching away from the paper dollar.

Rather than asking citizens if we should save 6 billion dollars, we should be asking if citizens would be willing to give up the paper dollar in exchange for 67 cents. My guess is that many will be willing to pay the 67 cents for what they see as a convenience. After all, some banks now want to charge $60 per year for an ATM card.

I, of course, am a coin man. I pay for virtually everything in coins (much to the dismay of those waiting behind me in the checkout line). The question is whether the government should force all Americans to be more like me. What are your thoughts?

Will the government seize the Norfed liberty dollars?

Comments from the federal government has led to new fear that the secret service may try to seize the privately minted liberty dollars. The courts have ruled that they are considered counterfeit and the secret service confiscates counterfeits. One immediate result of this is that the Norfed liberty dollars are becoming harder to find. On my website's liberty dollar page , I have listed a few places to find them along with more information about these so-called dollars.

A trip to a coin-less Las Vegas

Today I find myself in Las Vegas, Nevada, where the main industry is gambling. While touring the vast expanse of slot an video poker machines -- I noticed something was missing. There are absolutely no coins here. To play a slot machine, one can insert paper money. Buttons are pushed to bet quarters, dollars, or whatever. At the end, the player pushes the payout button and receives a voucher representing the cash won. As the machine prints the voucher, it generates artificial sound of coins clinking through the machine. But gone are the days of players holding there casino cups brimming with silver quarters and dollars.

Casinos have played a significant role in our coinage. Many of the Morgan dollars , shunned by the citizens at large, were distributed by the treasury for use in the casinos. In 1965, Lyndon Johnson ordered the minting of the "1964 D Peace dollars " to satisfy the gambling industry. Click here to see my brief educational video on the 1964 D Peace Dollar . And so, we have another example of our shift to a society in which coins may becoming obsolete.

Casinos have played a significant role in our coinage. Many of the Morgan dollars , shunned by the citizens at large, were distributed by the treasury for use in the casinos. In 1965, Lyndon Johnson ordered the minting of the "1964 D Peace dollars " to satisfy the gambling industry. Click here to see my brief educational video on the 1964 D Peace Dollar . And so, we have another example of our shift to a society in which coins may becoming obsolete.

Gold passes Platinum!

August 8, 2011 was a historic day. With the background of a crashing stock market, the price of gold closed at $1753 an ounce, up $56 for the day. For comparison, platinum closed at $1714 an ounce, up a modest $2 for the day. An ounce of gold is now worth more than an ounce of platinum. This is despite the fact that platinum is much rarer than gold. The US downgrade by Standard and Poor's contributed to the frenzy. The big question is why is there not a similar platinum mania?

For centuries gold has been used as money, whereas platinum is a johnny-come-lately. But worldwide mints are producing platinum bullion in quantities much less than the gold counterparts. The demand, however seems to be for gold.

In my view, this inversion of the gold and platinum prices should not last. Should we short gold to buy platinum? A good question, but Dr. Planchet does not give investment advice.

For centuries gold has been used as money, whereas platinum is a johnny-come-lately. But worldwide mints are producing platinum bullion in quantities much less than the gold counterparts. The demand, however seems to be for gold.

In my view, this inversion of the gold and platinum prices should not last. Should we short gold to buy platinum? A good question, but Dr. Planchet does not give investment advice.

Court rules that government rightfully seized 1933 double eagles

A jury in Philadelphia has ruled that the government rightly seized ten 1933 double eagles from the Langbord family. The Langbords claimed they discovered the double eagles in a safe deposit box belonging to their grandfather, Israel Switt. The government claimed that Switt stole them. See my previous entry on the 1933 double eagle trial for details.

The result of the case leads me to several conclusions:

- All other 1933 double eagles will remain in hiding. It is highly unlikely that the government has seized every 1933 double eagle that escaped. When the Langbords found the double eagles, they gave them to the treasury to authenticate. No one else will make that mistake.

- Other coins that were not legally released by the mint could be in trouble. Will the government attempt to seize 1913 liberty head nickels, the 1804 silver dollar, or other coins made clandestinely at the mint? So far the government has been fixated solely on the 1933 double eagles. Other coins are probably safe for now, but should a collector pay millions of dollars for a coin that the government may later seize?

- What will happen to the seized double eagles? For now, the government says it will display them. Will they be auctioned in the future?

Saint Gaudens 1933 Double Eagle Trial set to start

One of the biggest coin trials ever will soon begin in Philadelphia. The case, Roy Langbord vs. United States Department of the Treasury involves ten 1933 double eagles . The Langbord family allege that they discovered the double eagles in a safe deposit box belonging to their grandfather, Israel Switt. After discovering the coins, the Langbords sent them to the US Treasury to be authenticated. The treasury confiscated them. Now the Langbords are suing to get them back.

In 1933, 445,500 double eagles designed by Augustus St. Gaudens , were minted. Franklin Roosevelt then issued an order prohibiting banks from paying out gold as well as all private ownership of gold. Virtually all of the 1933 Double Eagles were melted. The United States government has been confiscating virtually all 1933 double eagles saying that they were stolen from the mint. The government believes that Israel Switt was involved with all of the 1933 double eagle thefts. Switt, however, was never charged.

How did these coins escape the melting pot? The courts feel that the government will have to prove the coins were stolen. Meanwhile, an alternate hypothesis has arisen. A mint employee kept an open bag of 1933 double eagles on his desk, which he gave to people in exchange for $20 -- perfectly legally.

In my analysis, I have one question. The government alleges that the Langbord's knew that they had coins that their grandfather stole. Why then would they submit the stole coins to the treasury? Perhaps we will get the answer as the trial unfolds.

In 1933, 445,500 double eagles designed by Augustus St. Gaudens , were minted. Franklin Roosevelt then issued an order prohibiting banks from paying out gold as well as all private ownership of gold. Virtually all of the 1933 Double Eagles were melted. The United States government has been confiscating virtually all 1933 double eagles saying that they were stolen from the mint. The government believes that Israel Switt was involved with all of the 1933 double eagle thefts. Switt, however, was never charged.

How did these coins escape the melting pot? The courts feel that the government will have to prove the coins were stolen. Meanwhile, an alternate hypothesis has arisen. A mint employee kept an open bag of 1933 double eagles on his desk, which he gave to people in exchange for $20 -- perfectly legally.

In my analysis, I have one question. The government alleges that the Langbord's knew that they had coins that their grandfather stole. Why then would they submit the stole coins to the treasury? Perhaps we will get the answer as the trial unfolds.

A couple of Benjamins for my daughter's graduation

My daughter, Rachel Planchet graduated from high school. I had spent much time pondering what gift to give, when she said "Dad (She calls me Dad instead of Dr. Planchet), How about just giving me a couple of Benjamins?" Honoring her wish, I found two Benjamin Franklin half dollars and put them in a card. Congratulations, Rachel. Good luck in college.

The Liberty Dollar: What the government didn't like

As I write this, Bernard von NotHaus, the inventor of the so-called "liberty dollar" awaits sentencing after being convicted of making, possessing and selling his own coins. The coins were made by the Sunshine mint, which also makes many silver rounds which are not scrutinized. So what are the problems with the liberty dollar?

First, the coins looked as if it might be a legitimate coin produced by the US government. It contained an image of liberty (later replaced with Ron Paul) that looked reminiscent of classic coins from the 1880's such as the liberty nickel or morgan dollar . In particular it contained the word "liberty" and a motto "Trust in God" which is similar to "In God we Trust." The bigger problems appear on the reverse of the coin, where a denomination is given. The original one ounce liberty coins had a denomination of $20 (even when silver was around $8 an ounce). Both the dollar sign and the word "dollar" were used, making it appear as if these were US coins.

The government also did not care for Bernard von NotHaus' politics and planned use for the coins. Mr. NotHaus clearly wished to place the coins into circulation to compete with US coinage. When the government called his coins "counterfeit" he filed suit against the government. The government is clearly threatened by any introduction of alternate currency. Anne Thomkins, the US attorney called the liberty dollar "a unique form of domestic terrorism." and called it a "challenge to the legitimacy of our democratic form of government."

The government would prefer that there be no discussion of alternate currencies. They ordered the shutdown of the website libertydollar.org. Von NotHaus' book,The Liberty Dollar SOLUTION To the Federal Reserve is still available, but in short supply.

is still available, but in short supply.

Is the liberty dollar a true threat to our democracy. Despite Ms.Thomkins hyperbole, I hope our democracy is not that weak.

The initial seizure of the coins and the subsequent conviction caused the price of the coins to skyrocket. It is still possible to purchase a Liberty dollar coin . Yes, nothing increases interest and value more than the government banning something. Liberty dollar collectors may need to feel slightly nervous. Are they possessing counterfeit coins? Will the federal government target collectors?

. Yes, nothing increases interest and value more than the government banning something. Liberty dollar collectors may need to feel slightly nervous. Are they possessing counterfeit coins? Will the federal government target collectors?

Whatever happens, the Liberty dollar is sure to have its place in US numismatic history along with other privately minted coins such as the Hard Times Tokens and Mormon gold coins.

Five ounce Silver Bullion Coins -- Here they Come! (but read the caution first)

Tomorrow, April 28 at noon is when the mint will be selling the first of their America the Beautiful Five ounce silver bullion coin, depicting Hot Springs in Arkansas. The price will be a whopping $279.95 per coin with a household limit of one. With silver approaching $50 an ounce, the markup is unexpectedly modest.

The mint expects its computer to be overwhelmed, and a quick sellout is anticipated.

The hype reminds me of another series that is fizzling out. I speak, of course of the first spouse gold coin series. The first issues sold out quickly. Then the price of gold (and the prices of the subsequent issues) rose dramatically. Suddenly, there were few who could afford to collect the series.

sound familiar? At current prices, those who want to collect the oversized quarters will be paying $1400 per year for the five quarters that are issued annually. The entire series will have 56 coins. That means it will cost nearly $16,000 for a complete set. I predict that interest will be lost before the series expires.

The mint will dramatically increase its production for subsequent years, thus guaranteeing that the 2010 set will be the rarest and most valuable.

I wish you the best of luck battling the mint's computers for the right to purchase one.

The war against the paper dollar continues

The General Accountability (GAO) office has released a new statement on how much money the nation would save if we exclusively used dollar coins and terminated the paper dollar. At first the savings seem staggering: The GAO announced that we would save 5.5 billion dollars over the next thirty years.

I'm sure this is old hat to most of you, but we've had a dollar coin (on and off) since 1794). Sadly, dollar coins have never been popular with Americans. As a numismatist, I hate to admit it, but Americans love paper. I have documented this on my cynical history of the US dollar.

The big deception is the quoted savings is over a period of 30 years. The savings is, therefore 180 million dollars per year. With a population of approximately 300 million people, this means that each US citizen will save approximately 60 cents per year if we make the paper dollar bill defunct. Compared to other government expenditures, this savings is negligible. Sorry, GAO, I'm not buying your argument.

I'm sure this is old hat to most of you, but we've had a dollar coin (on and off) since 1794). Sadly, dollar coins have never been popular with Americans. As a numismatist, I hate to admit it, but Americans love paper. I have documented this on my cynical history of the US dollar.

The big deception is the quoted savings is over a period of 30 years. The savings is, therefore 180 million dollars per year. With a population of approximately 300 million people, this means that each US citizen will save approximately 60 cents per year if we make the paper dollar bill defunct. Compared to other government expenditures, this savings is negligible. Sorry, GAO, I'm not buying your argument.

Silver Certificates -- not valid for silver -- how about for tea?

Silver certificates contain the statement :"This certifies that there is on deposit in the treasury of the United States of America one dollar in silver payable to the bearer on demand." The statement represents a broken promise from the United States government. I have a stack of silver certificates. The U.S. government stopped redeeming them for silver in 1964. There is no expiration date on the bill. Our government promised us silver and did not deliver.

I gave a well-worn silver certificate to my daughter, Rachel Planchet. At school, she became thirsty, and went to a drink machine to attempt to purchase a bottle of peach tea. The machine refused to accept her silver certificate.

Two generations of Planchets have now been thwarted by certificates that we could redeem for neither silver nor tea.

Subscribe to:

Comments (Atom)